Over the past couple of years, the number of companies committing to net-zero has dramatically increased. Currently, over 5,200 businesses have committed to or set a Net Zero target as part of the UNFCCC’s “Race to Zero” campaign [1]. Furthermore, about 750 of the 2,000 largest publicly listed companies have committed to some form of net zero or climate neutrality target. However, the integrity and breadth of these commitments vary widely with regard to timelines, types of greenhouse gases (GHG) covered, and scopes included in their target.

This discrepancy reflects the fact that the term “Net Zero” is still a poorly understood concept by many and it is even less well implemented in corporate strategies. A particular area of contention rests on the use of offsets, either in the form of carbon removals or reductions, and the role they should play in corporate climate commitments. In the paragraphs that follow, we aim to shed light on what a science-based Net Zero strategy that includes the purchase of offsets should take into consideration.

The Net Zero landscape

Companies on the road to developing their Net Zero strategies will find themselves in no short supply of guidance to use. For now, the best practice when setting targets is to use the “Net Zero Standard” by the Science Based Targets initiative (SBTi). Another useful resource is Carbone 4’s “Net Zero Initiative”. In addition to providing guidance on SBT setting, SBTi also independently assesses and approves organizations’ targets. Carbone 4’s framework details different actions that can be taken both inside and outside a company’s value chain across the following three pillars: reducing the company’s own emissions, reducing other’s emissions, and removing CO2 from the atmosphere [2]. While their guidance is consistent with each other, Carbone 4 does not allow for a company to claim “Net Zero” status, but rather to communicate about its contribution to the targets of the national territory it is located in.

On the role of offsetting in rigorous climate strategies, a useful resource companies can use is the Oxford Principles for Net-Zero Aligned Carbon Offsetting. These outline four principles that if adhered to can have a credible climate impact, as opposed to greenwashing [3]. These are:

Prioritise reducing your own emissions first, ensure the environmental integrity of any offsets used, and disclose how offsets are used

Shift offsetting towards carbon removal, where offsets directly remove carbon from the atmosphere

Shift offsetting towards long-lived storage, which removes carbon from the atmosphere permanently or almost permanently

Support for the development of a market for net-zero aligned offsets

In addition to this, there are also various networks and alliances that work to ensure the integrity of the voluntary carbon market.

On the supply-side, the Integrity Council for the Voluntary Carbon Market (IC-VCM) has recently published the “Core Carbon Principles” which aims to set a robust benchmark for companies to identify credible, high-integrity carbon credits, that create high environmental and social value.

On the demand-side, the Voluntary Carbon Markets Integrity Initiative’s (VCMI) ambition is to set the standard for high integrity use of carbon credits in organisations’ climate strategies. Their Provisional Claims Code of Practice outlines clear guidance on how companies can make transparent and credible claims regarding offsetting and provides a framework for rating companies’ efforts on three levels: Gold, Silver, and Bronze.

Both are designed to be used in tandem with SBTi’s Net Zero Standard.

What is the meaning of Net Zero?

“Net Zero”, “carbon neutral”, and “climate neutral” are just a couple of examples of seemingly synonymous climate jargon, used by companies to characterise their climate efforts. While they are often used interchangeably, there are subtle differences between them, mainly relating to the coverage of different greenhouse gases, timelines and scale of emissions reductions required, the requirement for targets to be science-based, and most significantly, the role of offsetting and type of offsets allowed.

While Net Zero requires companies to drastically reduce emissions within their value chain in line with science, climate or carbon neutral can mean that emissions are balanced out by offsets. As a result, Net Zero is only achieved once long-term emission reduction goals are met and residual emissions neutralised, whereas climate neutrality can be claimed by any entity that has fully offset their emissions in a given year. However, the current lack of standardised definitions and oversight bodies means that companies will ultimately be able to do what they want – at the risk of being called out for greenwashing.

A source of confusion is the definition of Net Zero itself. The IPCC defines a state of Net Zero emissions as: “when anthropogenic emissions of greenhouse gases to the atmosphere are balanced by anthropogenic removals over a specified period” [4]. Whilst this definition applies to the planet as a whole, some claim it does not hold at an individual company level. For this reason, Carbone 4 maintains that organisations can only contribute to global climate targets but cannot achieve a final state of Net Zero.

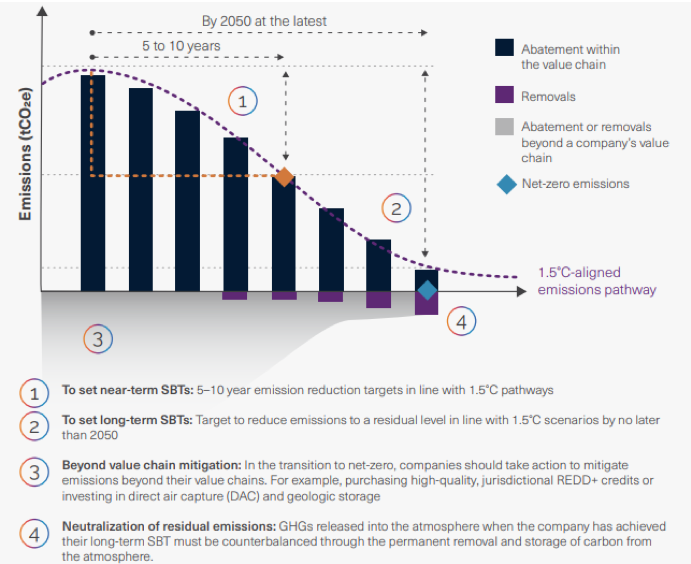

Figure 1: Elements of the Net Zero Standard [5]

While there is currently no universally agreed upon definition of a Net Zero strategy, under the SBTi’s guidance, to determine their baseline emissions, companies must undertake a comprehensive GHG inventory that covers at least 95% of their scope 1 and 2 emissions and a complete scope 3 screening, usually using the GHG Protocol guidance. From this, they must set both near-term and long-term emission reduction targets. Long-term targets must be achieved by 2050 latest, whereas near-term targets must be achieved 5-10 years after having committed to net zero, typically around 2030.

For targets relating to scopes 1 (direct emissions), 2 (indirect from heat and electricity), and 3 (indirect emissions) employing the absolute contraction method, the long-term target should represent an emissions reduction of 90% relative to the baseline year. The baseline year can be chosen by the companies themselves, provided that they have enough information on Scope 1, 2 and 3 emissions for that year, that it is representative of the company’s typical GHG profile and can be no earlier than 2015. For scope 3 targets employing the physical intensity contraction method, the reductions should represent 97% of the baseline.

After reaching their long-term emissions reduction targets, companies must neutralise their residual emissions, using removals only, to ensure that any GHG still emitted by company are counterbalanced. Residual emissions, which refer to the hard-to-abate GHG emissions remaining after the achievement of a long-term Net-Zero target, must not represent more than 10% of the company’s baseline emissions.

How can carbon offsetting be incorporated?

The crucial point in all this is that carbon credits, whether removals or avoided emissions, cannot count towards the achievement of any emissions reduction target. Removal credits can only be used to neutralise residual emissions, but the rest of the way must be executed through a comprehensive emission abatement plan.

Therefore, the IPCC’s definition, where net zero emissions is defined as a balancing act between total emissions and total removals, may not be appropriate to be applied at the corporate level.

Instead, companies can purchase carbon removals or reductions credits to neutralise emissions on their way to achieving their Net Zero target. This is also referred to as beyond the value chain mitigation (BVCM). Doing so is also a requirement of the VCMI Claims Code of Practice. In this way, achieving climate neutrality can be seen as an interim measure on the path to achieving a long-term science-based Net Zero target.

Whichever offsetting strategy entities choose must be clearly detailed in their climate plan, including whether there are any conditions on their use. For example, some companies chose to only purchase removals, whereas others purchase both removals and avoided emission credits. Other conditions can relate to the additionality, permanence, verifiability, or other environmental or social co-benefits certain offsets may offer [6].

How to recognise credible offsets

One issue is that the onus is on the company itself to do research and find out what carbon offsets could be considered credible, yet only a few have the resources and skills to do this. What follows is that a number of purchased credits do not comply with strict integrity requirements. The most fundamental ones include:

Environmental integrity: Ensuring the use of the credits does not lead to an increase in global emissions [7]. What this refers to is the fact that emissions reductions should not be overestimated, be based on a conservative baseline, and take into account possible leakage.

Additionality: Establishing that the GHG emissions reductions or removals resulting from the mitigation activity would not have occurred in the absence of this project. Often this relies on demonstrating the project’s reliance on carbon revenues or that it does not fall under a host country’s climate commitment [8].

Permanence: Making sure that GHG reductions or removals are permanent and have a low risk of reversal, with any reversals being compensated. For agriculture, forestry and other land-use projects (AFOLU), which have a higher risk of reversal due to climatic conditions, wildfires, or deforestation, a percentage of credits are set aside in a buffer to compensate for any losses.

No double counting: Making certain that each credit only counts towards the achievement of one mitigation target or goal. In the context of Article 6 of the Paris Agreement, host countries are required to make corresponding adjustments if a mitigation outcome is being transferred internationally to meet a compliance target [9]. Whilst such adjustments will not be required for the voluntary carbon market unless purchasing credits authorised for Article 6, this will likely affect the voluntary carbon market in some way.

Avoiding social and environmental harms: Safeguards must be in place to ensure that the project does not contribute to any social or environmental harms, and respects laws and regulations. Certification standards such as the Climate, Community, and Biodiversity Standard (CCB) or programs to quantify sustainable development impacts such as the Gold Standard or the Sustainable Development Verified Impact Standard can offer additional safeguards that such harms are being avoided. It is however best practice to carry out due diligence of purchased credits regardless of the certification standard.

Different types of reductions and removals

A family in Sudan with a collection of firewood for cooking for 4 days. Photo by HAMERKOP.

GHG reduction credits represent avoided emissions resulting from decreasing the emissions intensity of a certain process. Reductions are calculated according to how the with-project emissions scenario compares to the hypothetical without-project scenario. For example, renewable energy projects reduce emissions by displacing fossil fuel electricity production. Furthermore, cookstoves projects reduce emissions by reducing demand for firewood as a cooking fuel and hence avoiding deforestation, as well as reducing black carbon emissions, a powerful radiative forcing. Further information about HAMERKOP’s expertise in energy access and clean cooking can be found here.

While investing in GHG reductions is an important tool in avoiding future emissions to pile up in the atmosphere, over time investment in permanent removals should also be scaled up substantially, to address past emissions. As explained above, to reach a state of Net Zero, residual emissions, which represent less than 10% of baseline emissions, can only be neutralised by removals.

Carbon Dioxide Removals (CDR) include biological or technological methods of sucking carbon dioxide out of the atmosphere and permanently storing them.

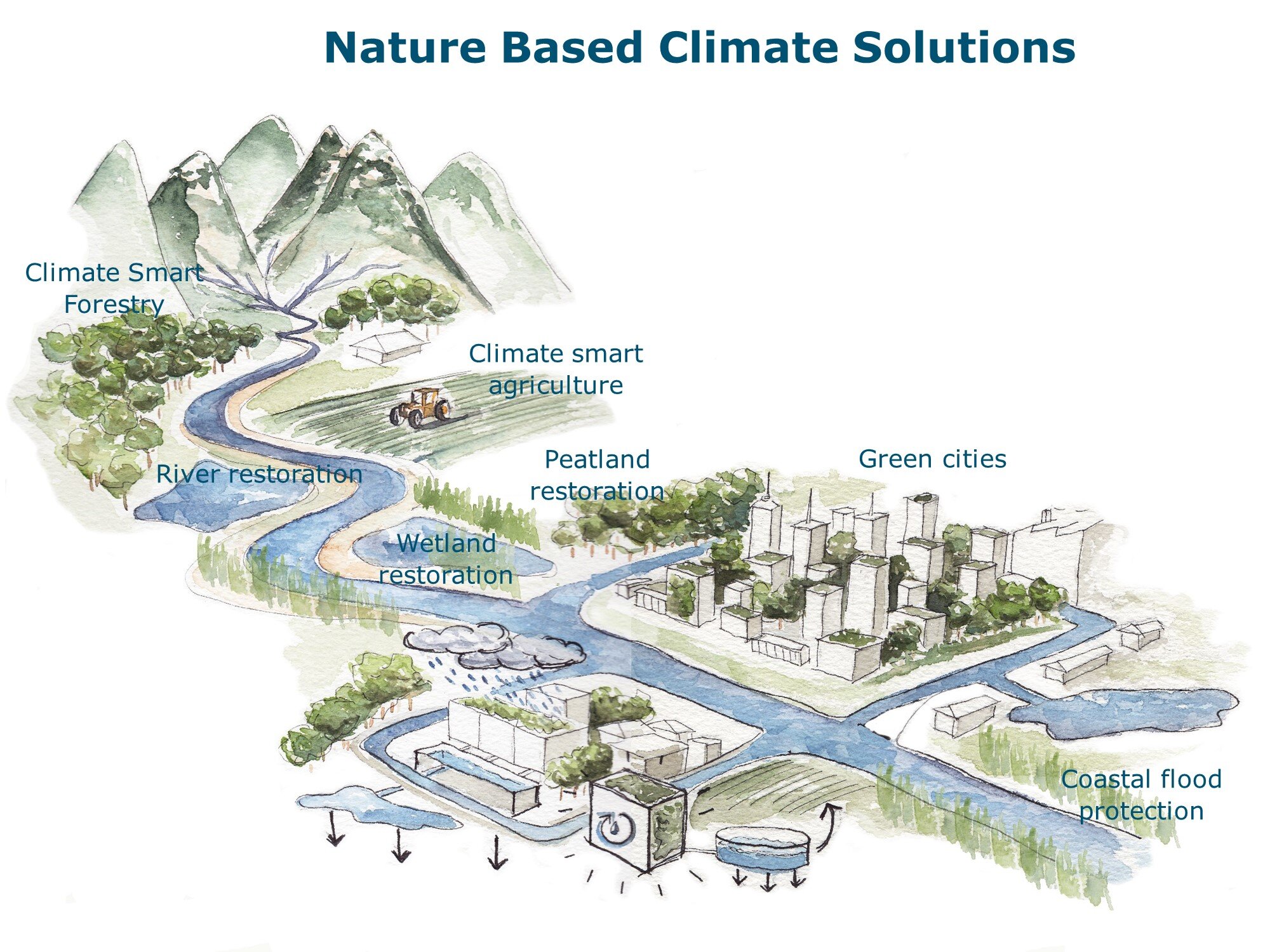

Currently, the most mature options at scale for carbon removals are Nature Based Solutions (NBS). These include tree planting and ecosystem restoration such as peatlands, mangroves, and seagrass meadows. At present, plants and soils in terrestrial ecosystems absorb the equivalent of around 20% of anthropogenic GHG emissions and are thus a key player in achieving Net Zero [10].

Figure 2: Estimated costs and 2050 potentials of CDR [13]

On the other hand, technological carbon removals are still unproven at scale but likely to play a measurable role [11]. Such engineered solutions to remove carbon from the atmosphere include carbon capture and storage (CCS), direct air capture (DAC), biochar, and enhanced weathering. Yet considerable investment is required to make these technologies have an impact on global mitigation. For instance, the largest DAC and storage plant running today only sequester about 4,000 tonnes CO2e per year, which approximately amounts to the yearly emissions of 870 cars [12].

A challenge for NBS removals is how to guarantee the permanence of removals given their vulnerability to a range of natural and human disturbances such as wildfires and deforestation.

Currently, under the major carbon certification standards, all Agriculture, Forestry and Other Land Use (AFOLU) projects undergo a non-permanence risk assessment to qualify the risk that a given tonne of GHG removed will be reversed in the next 100 years. Geological forms of storage, which includes many of the engineered carbon removal solutions, are much less vulnerable to reversal and are likely to be guaranteed for 1,000+ years. For this reason, it is important to also invest in longer-term more permanent forms of storage.

The major barrier to investing in technological carbon removals is their price, which also reflects the lack of maturity of their technology. In 2021, forestry and land use removals credits traded at around US$7.90 per tonne [14]. Today they sell for US$10-20. By contrast, the price per tonne of technological carbon removals can be US$200-600 [15].

The Frontier fund, set up by Shopify, Microsoft, Stripe, and others, aims to overcome this barrier by providing an advanced market commitment of $925 million for carbon removal technologies. Such actions send a powerful market signal and boost innovation and the development of such technologies by guaranteeing demand for them and bringing down their cost in the long run.

Conclusion

This article has intended to highlight that using carbon removal or avoided emission / reductions offsets can have a positive climate impact, so long as it takes place within a credible and ambitious Net Zero plan or strategy.

If companies choose to incorporate offsetting as part of their Net Zero strategy, it is important that they report on their purchases in a transparent way, set conditions for their use, and use best practice guidance to identify credible and high-integrity offsets. While investing in reductions is crucial in the long term, gradually scaling up investment in removals is instrumental to reaching the goals of the Paris Agreement.

HAMERKOP’s experts have more than a decade of experience supporting project developers, designing climate change mitigation interventions, carrying out technical feasibility studies and getting projects through the certification process to issue carbon assets.

Whether you are a company looking for guidance on how to integrate best quality carbon offsets, financially support long-term and impactful climate change mitigation intervention, or assess the quality of carbon offsets you intend to support, we can help – reach out to us.

References:

[1] UNFCCC, "Race To Zero Campaign", Unfccc.Int https://unfccc.int/climate-action/race-to-zero-campaign#eq-3 [Accessed 26 August 2022].

[2] Maxime Aboukrat and others, Net Zero Initiative 2020-2021 Final Report (Carbone 4, 2021) https://www.carbone4.com/files/Net_Zero_Initiative_Final_Report_2021_2021.pdf

[3] Myles Allen and others, "The Oxford Principles For Net Zero Aligned Carbon Offsetting", University Of Oxford, 2020 https://www.smithschool.ox.ac.uk/sites/default/files/2022-01/Oxford-Offsetting-Principles-2020.pdf

[4] IPCC, "Annex I: Glossary", in Global Warming Of 1.5˚C. An IPCC Special Report on the Impacts of Global Warming of 1.5˚C Above Pre-Industrial Levels and Related Global Greenhouse Gas Emission Pathways, in the Context of Strengthening the Global Response to the Threat of Climate Change, Sustainable Development, and Efforts to Eradicate Poverty (Cambridge: Cambridge University Press, 2018).

[5] SBTi, "SBTi Corporate Net-Zero Standard", Science Based Targets Initiative, 2021 https://sciencebasedtargets.org/resources/files/Net-Zero-Standard.pdf

[6] Kaya Axelsson, Aoife Brophy and Elena Pierard Manzano, "Net Zero Business or Business for Net Zero? A Report on Corporate Climate Leadership Practices on Scope and Offsetting", Skoll Centre For Social Entrepreneurship & Oxford Net Zero, 2022 https://netzeroclimate.org/wp-content/uploads/2022/02/Net-zero-business-or-business-for-net-zero.pdf

[7] Lambert Schneider and Stephanie La Hoz Theuer, "Environmental Integrity of International Carbon Market Mechanisms Under the Paris Agreement", Climate Policy, 19.3 (2019) https://doi.org/10.1080/14693062.2018.1521332

[8] Lambert Schneider and others, "What Makes a High-Quality Carbon Credit?", WWF, EDF & Öko-Institut, 2020 https://files.worldwildlife.org/wwfcmsprod/files/Publication/file/54su0gjupo_What_Makes_a_High_quality_Carbon_Credit.pdf?_ga=2.218034974.983871514.1660815690-932968438.1660815690

[9] Trove Research, "VCM And Article 6 Interaction Discussion Paper On The Use Of Corresponding Adjustments For Voluntary Carbon Credit Transfers", 2021 https://globalcarbonoffsets.com/wp-content/uploads/2021/01/VCM-and-Article-6-interaction-6-Jan-2021-1.pdf

[10] Bronson W. Griscom and others, "Natural Climate Solutions", Proceedings of the National Academy of Sciences, 114.44 (2017) https://doi.org/10.1073/pnas.1710465114

[11] Robert Höglund, "The Carbon Removal Market Doesn't Exist", Illuminem.Com, 2022 https://illuminem.com/illuminemvoices/dd812162-ba25-4321-95dd-2b0208bc489b [Accessed 19 August 2022].

[12] Katie Lebling and others, "6 Things To Know About Direct Air Capture", World Resources Institute, 2022 https://www.wri.org/insights/direct-air-capture-resource-considerations-and-costs-carbon-removal [Accessed 23 August 2022].

[13] IPCC, "Chapter 4: Strengthening and Implementing the Global Response", in: Global Warming of 1.5°C. An IPCC Special Report on the Impacts of Global Warming of 1.5°C Above Pre-Industrial Levels and Related Global Greenhouse Gas Emission Pathways, in the Context of Strengthening the Global Response to the threat of Climate Change, Sustainable Development, and Efforts to Eradicate Poverty (Cambridge: Cambridge University Press, 2018) https://www.ipcc.ch/site/assets/uploads/sites/2/2022/06/SR15_Chapter_4_LR.pdf

[14] Stephen Donofrio and others, The Art of Integrity State of the Voluntary Carbon Markets 2022 Q3 (Ecosystem Marketplace, 2021).

[15] cdr.fyi, "Compilation of Known CDR Purchases", Cdr.Fyi, 2022 https://www.cdr.fyi/ [Accessed 19 August 2022].