At COP29, one message rang loud and clear: the money isn’t flowing fast enough. After intense negotiations, developed countries agreed to mobilise $300 billion per year through 2035 to help developing nations tackle climate change. But that’s far below the estimated $1.3 trillion per year that low- and middle-income countries say they need to stay on track.

This growing finance gap raises an urgent question: how can we unlock new sources of funding to meet the scale of the challenge? One powerful answer is carbon pricing, a mechanism that turns emissions into a cost, and climate action into a market opportunity. By placing a price on carbon emissions, it creates the incentive and financial logic for companies and governments to reduce their footprint and invest in climate solutions.

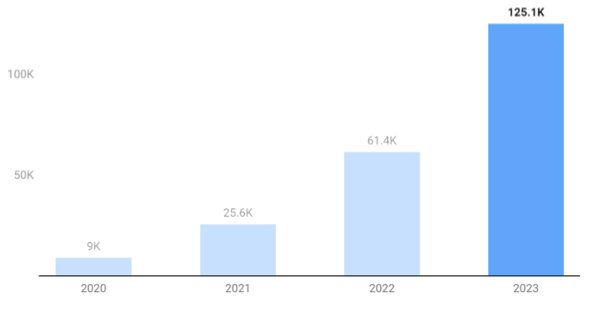

At the centre of this mechanism is the carbon credit, a unit representing the reduction or removal of one tonne of CO₂ or its equivalent. These credits are traded in compliance and voluntary carbon markets. And while the carbon market has faced its share of challenges, it is rapidly evolving and increasingly recognised as a tool that can move money where it’s needed most.

But success isn’t guaranteed. Issues like over-crediting, unclear baselines, weak co-benefit integration, and upfront cost barriers have all slowed progress. If we want to harness the full potential of the carbon market, we need to get serious about quality, credibility, and strategy.

At HAMERKOP, we’ve worked on over 150 climate finance assignments across more than 50 countries. From this experience, we’ve distilled six principles that can help project developers design and deliver carbon projects that not only reduce emissions, but also command higher prices, attract the right buyers, and deliver lasting impact.

1. Understand the demand for your type of carbon credit

Just like in any market, the price of carbon credits is influenced by supply and demand. In the voluntary carbon market, demand is largely driven by the growing number of global companies making net-zero commitments and seeking to offset their residual emissions. These pledges are translating into real purchases, particularly during companies’ annual carbon credit retirement cycles, when they retire credits to meet their public climate goals.

A strong example of this trend is Google’s US$200 million pledge to Frontier. Frontier is an initiative that secures long-term demand for carbon removal technologies by supporting project developers with early financial certainty. Through this commitment, Google and other backers are helping ensure that the market continues to move toward high-quality, permanent carbon removal solutions.

However, demand is not uniform or guaranteed. It fluctuates based on broader economic conditions, regulatory changes, internal decarbonisation progress within companies, and the shifting relationship between voluntary and compliance carbon markets. For project developers, understanding these dynamics is essential in order to align their efforts with where the market is heading.

Before investing in a project, developers should assess where demand is strongest and what buyers are actually looking for. This includes identifying whether current interest leans more toward removals or reductions, which social and environmental co-benefits are valued most, and which geographies are emerging as high-potential regions. Market platforms such as Climate Impact X offer real-time insight into buyer preferences, while reviewing requests for proposals and engaging with buyers or intermediaries early on can provide strategic direction.

Selecting the right carbon standard and methodology is equally important. As the Integrity Council for the Voluntary Carbon Market continues its work to define “high-integrity” through its Core Carbon Principles, buyers are increasingly favouring credits aligned with these criteria. Projects that meet these emerging expectations from the outset are more likely to attract serious interest and secure better prices as the market shifts toward greater transparency and accountability.

2. Design for co-benefits, not just carbon

The carbon market is evolving quickly, and so are buyer expectations. It is no longer just about how many tonnes of CO₂ a project can reduce or remove. Increasingly, buyers are asking what else the project delivers. Projects that provide environmental and social co-benefits such as improved local livelihoods, restored biodiversity, or progress on gender equality are viewed as higher quality and are more likely to receive a premium price.

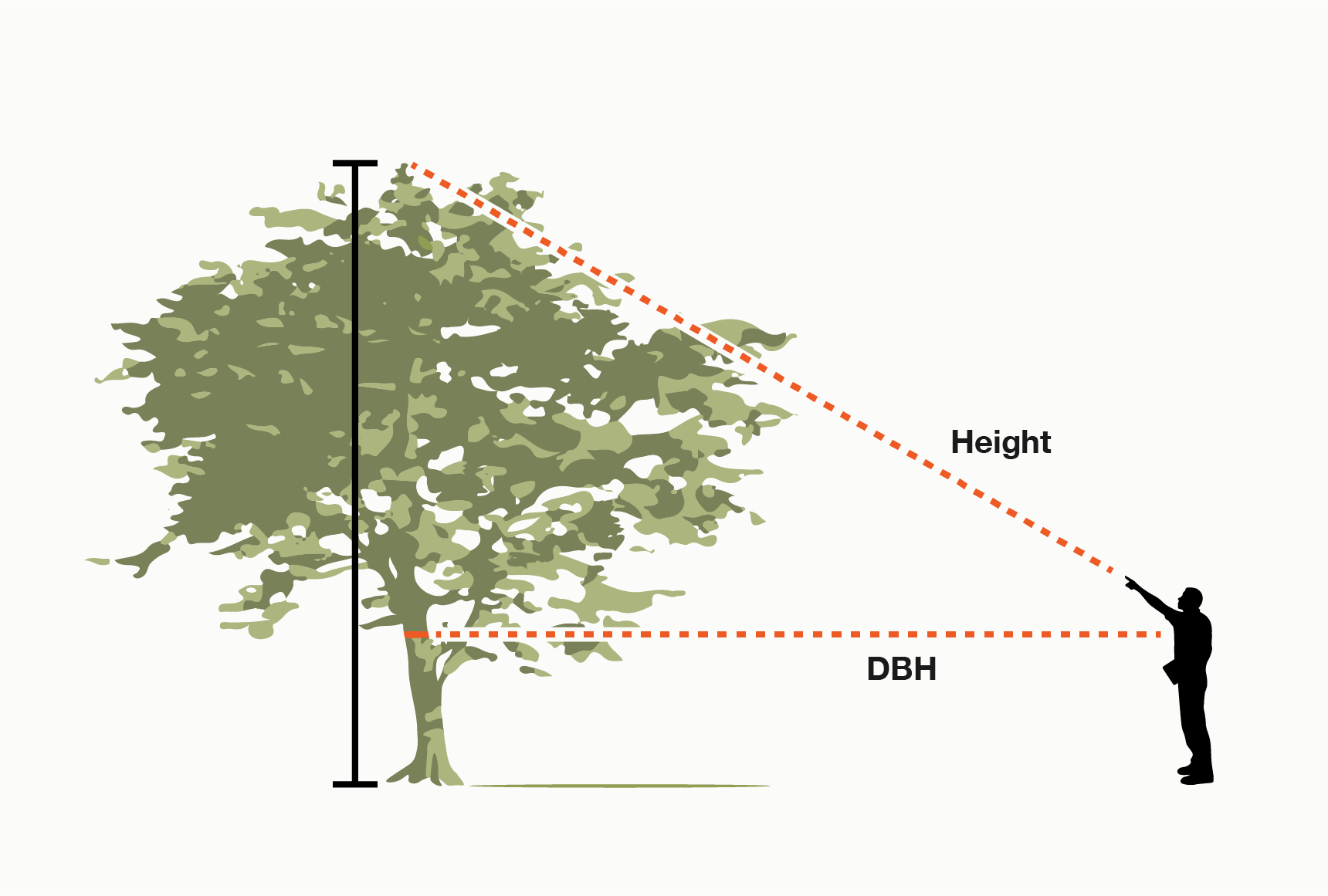

These “beyond carbon” contributions are increasingly seen as indicators of both quality and ambition. Buyers and investors are actively seeking projects that align with broader sustainable development goals. In response, many developers are adopting more holistic approaches that place greater emphasis on social, biodiversity, and wider environmental outcomes. This is reflected in the use of methodologies with more rigorous baselines, monitoring systems, and safeguards to ensure these co-benefits are credible and lasting. Some are also leveraging emerging technologies to enhance transparency and traceability.

These co-benefits can also be formally recognised through co-certification schemes. Climate, Community, and Biodiversity Standard (CCB) Sustainable Development Verified Impact Standard (SD VISta) allow projects to demonstrate their wider impact. These labels help build trust with buyers and can justify premium pricing.

Designing for co-benefits is no longer just a nice-to-have. Particularly for nature-based projects, it is a smart strategy in a market increasingly values credibility, inclusiveness, and long-term impact. Projects that can show clear, measurable benefits beyond carbon will have a stronger position and greater appeal as expectations continue to rise.

3. Think strategically about offtake agreements vs. spot transactions

The way you sell your carbon credits can have a major impact on your project's financial sustainability and long-term success. Developers typically choose between two main options: spot transactions or offtake agreements. Each approach has its own benefits and challenges.

Spot transactions involve selling credits at the current market price, providing immediate income and greater flexibility. This can be useful for projects seeking short-term cash flow. However, spot sales expose projects to market fluctuations, making it harder to predict revenue and plan for future operations or reinvestments.

In contrast, forward purchase agreements and long-term offtake deals offer more financial stability. These agreements secure a buyer or group of buyers at a fixed price for credits delivered over several years. The predictable income helps cover early-stage costs, ongoing expenses, and can even support pre-financing strategies, such as loans or grants backed by future revenue. This model is especially beneficial for projects that are capital intensive or in their early stages of development.

It is also important to consider the type of buyer. Aggregators, brokers, and large corporate purchasers can streamline transactions, reduce negotiation burdens, and broaden market access. However, selling directly to an end buyer can increase margins and foster stronger partnerships, particularly when the buyer’s values align closely with the project’s goals.

No matter the sales strategy, transparency is essential. Clear delivery schedules, contractual terms, and alignment with the buyer’s sustainability objectives help build trust and credibility. This not only supports the immediate sale but also enhances the project’s reputation and resilience in the evolving carbon market.

4. Stay ahead of compliance trends

The line between voluntary carbon markets and compliance markets is becoming increasingly blurred. This convergence is opening up new opportunities for project developers while also raising the bar for quality and credibility.

As the global carbon landscape evolves, new frameworks are reshaping how credits are issued, certified, and valued. Key initiatives include Article 6 of the Paris Agreement, Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), and integrity-focused platforms such as the Integrity Council for the Voluntary Carbon Market (ICVCM) and the Voluntary Carbon Markets Integrity initiative (VCMI). Buyers are now looking for credits that come with additional certifications or labels, which indicate that the credits meet emerging standards for environmental integrity, transparency, and compatibility with future compliance use.

Although many host countries are still setting up systems to implement Article 6, demand for high-integrity credits is already growing. Governments, airlines, and institutional investors are preparing to source credits that meet international compliance requirements. These credits are expected to trade at higher prices because of their added credibility and potential regulatory value.

Some countries have already built formal links between voluntary and compliance markets. Singapore allows companies to offset up to five percent of their carbon tax obligations using approved international voluntary credits. Other jurisdictions such as Colombia, Chile, South Africa, and California have created compliance programs that accept certain emission reduction credits. These hybrid systems are strengthening market confidence and encouraging the development of compliance-aligned VCM projects.

Meanwhile, integrity initiatives such as ICVCM and VCMI are playing an increasingly influential role in the carbon market. By setting clear criteria for what defines a high-quality carbon credit and how such credits should be used, these organisations are shaping market expectations and buyer behaviour. As a result, credits aligned with frameworks like ICVCM are seen as more credible and are better positioned to attract premium prices.

For project developers, this convergence represents both a challenge and an opportunity. Looking ahead, aligning with compliance-grade methodologies and securing recognised third-party certifications may significantly increase a project's value and future-proof it in a rapidly changing market.

5. Promote your project with purpose and precision

In the carbon market, how you communicate your project is just as important as how you design it. Clear, credible communication shapes how buyers perceive your project and can significantly influence how much they are willing to pay for your carbon credits.

Buyers are not only purchasing emissions reductions; they are investing in a story. Projects that effectively highlight their co-benefits and broader environmental or social impact tend to stand out. Whether your project restores degraded landscapes, empowers communities, or protects biodiversity, presenting these elements through a compelling narrative attracts buyers who value integrity and are often willing to pay a premium for it.

However, storytelling alone is not enough. Credibility matters. The voluntary carbon market has faced growing scrutiny, with several high-profile controversies casting doubt on certain project types. Even high-quality projects can be overlooked if they are not understood or trusted. In this environment, buyers are exercising greater caution and placing more emphasis on transparency, independent verification, and solid governance structures.

This shift in buyer behaviour presents an opportunity. Projects that prioritise strong communication, pursue recognised certifications, and actively engage stakeholders can build trust and stand apart in a crowded market. By clearly demonstrating impact and positioning your project as part of the solution, you enhance its credibility and increase the likelihood of securing premium pricing for your credits.

6. Demonstrate low risk and build market confidence

As the voluntary carbon market becomes more mature, transparent, and focused on quality, the role of risk perception in pricing is growing rapidly. Buyers are becoming more selective, and they are rewarding projects that can clearly demonstrate credibility, integrity, and low exposure to risk.

One of the clearest indicators of this shift is the rise of carbon credit ratings. These ratings directly influence how credits are priced. Projects that receive high ratings based on factors such as quality, permanence, and additionality are more likely to attract premium pricing. In contrast, projects with lower ratings may struggle to find serious buyers. For developers, earning a strong rating can improve market visibility and send a powerful signal to prospective partners.

At the same time, price transparency in the market is improving. More platforms are making credit benchmarks publicly available, allowing developers to better assess the market value of their credits. This shift supports fairness and reduces the influence of speculation or misinformed pricing, especially for high-integrity projects.

Reputation has also become a key differentiator. Corporate buyers, in particular, are under increasing pressure to avoid the reputational risks associated with greenwashing. As a result, they are gravitating toward projects that can demonstrate clear additionality, measurable co-benefits, and robust third-party monitoring and verification. These qualities help position a project as trustworthy and align with what buyers now expect from responsible investments.

The conclusion is clear. In a market where quality and credibility drive demand, demonstrating your project’s low-risk profile is no longer a nice-to-have. It is a strategic advantage that can improve market access, build buyer trust, and support stronger credit pricing.

Final Thoughts

The voluntary carbon market is evolving quickly. While challenges remain, there are growing opportunities for project developers who are strategic, transparent, and focused on delivering meaningful impact.

By understanding buyer demand, designing projects with co-benefits, adopting strong financial strategies, aligning with compliance frameworks, communicating with credibility, and managing risk effectively, developers can unlock real value and stand out in the market.

At HAMERKOP, we help developers and investors build high-quality, investable carbon projects across all major standards and sectors. Our work spans REDD+, blue carbon, energy access, biochar, agriculture, agroforestry and reforestation. We are committed to helping you translate ambition into action and deliver measurable, lasting results. Get in touch to learn how we can support your next climate initiative.